Investment Approach

Unlike many investment advisors in today’s environment who simply perform an asset allocation model and “fill it in” with funds and outside managers, which layer on additional expense, each Radnor Capital Management portfolio holds its own individual securities. We have several investment strategies that meet the needs of our clients. Each portfolio is built based on our clients’ investment objectives and risk tolerance. Our investment process is designed to mitigate risk while meeting our clients’ objectives. Each of our client’s portfolio’s share four traits:

- A focused portfolio of 35 to 50 stocks

- Companies with attractive financial characteristics such as strong balance sheets, and sustainable earnings and dividend growth

- Security selection driven by rigorous research and fundamental analysis

- Tax and fee sensitivity

"What sets us apart is our independent approach to security selection and portfolio management. Our portfolio weightings are not benchmark driven, but rather based on risk/reward characteristics of individual securities. Without the noise of Wall Street, we perform our own research and make our assessments of worth and then deliver a compact, tax-efficient portfolio."

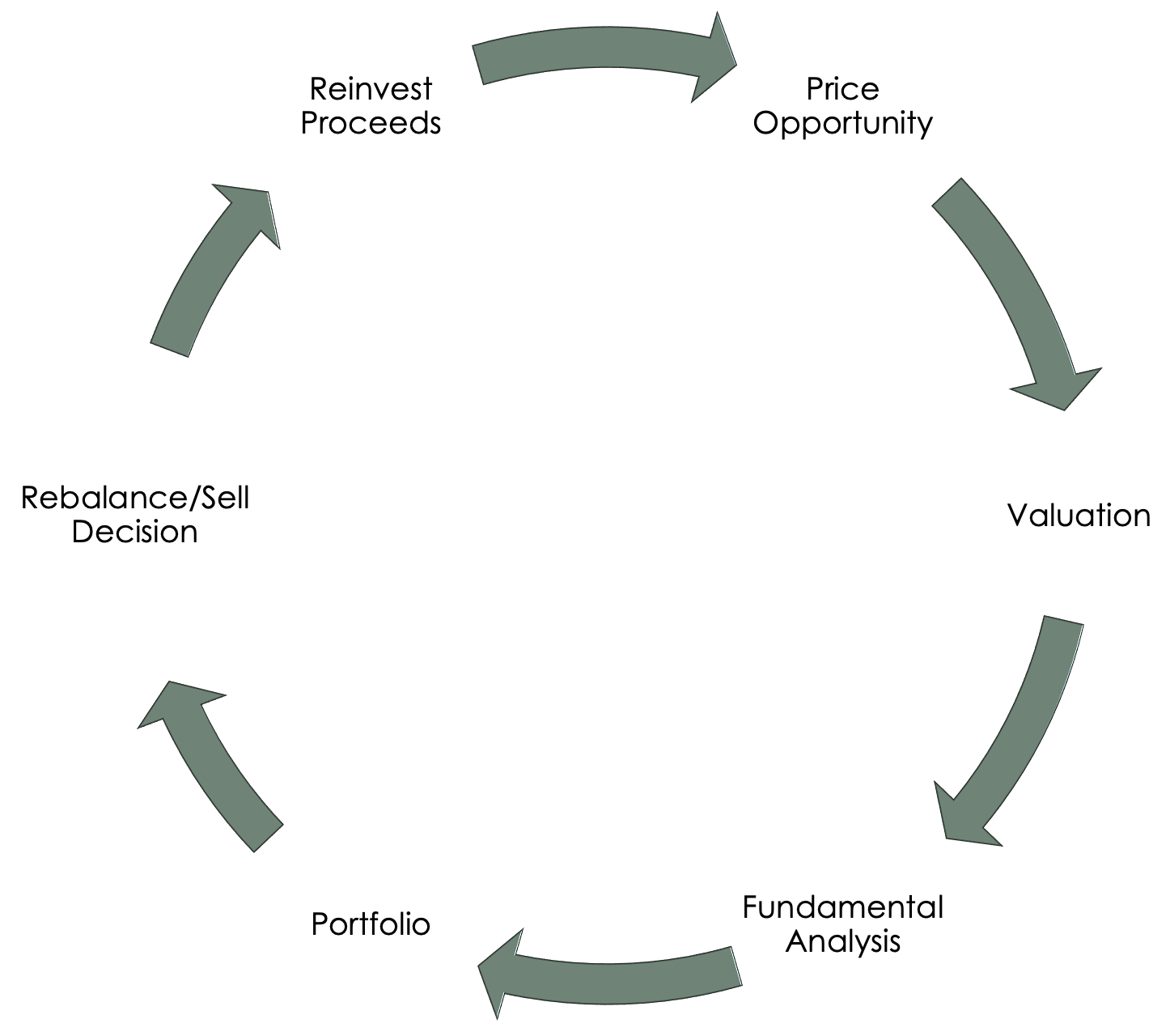

A Disciplined and Repeat Process